The market sold off yesterday, but we continue to see limited technical deterioration and are continuing to view this August-September pullback as primarily seasonal. Of course, there are always reasons for the pullback:

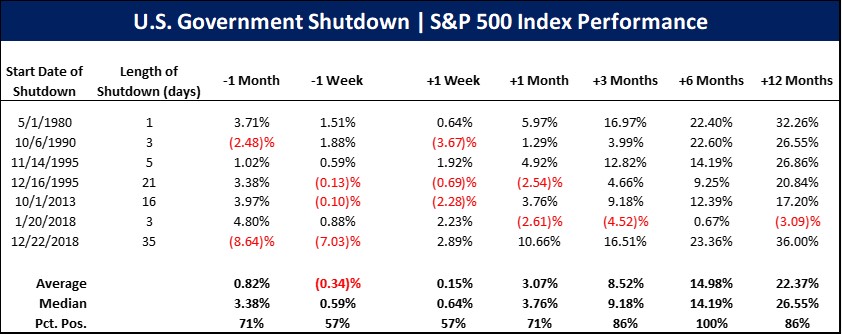

On the latter point, notice our analysis of previous US government shutdowns (table below). Historically, they have proven to be buying opportunities 6 and 12 months later. Note particularly, 6 months out, the S&P 500 has been up 100% of the time by an average of 14.98%!

*Vineyard Global Advisors, data sourced through Bloomberg

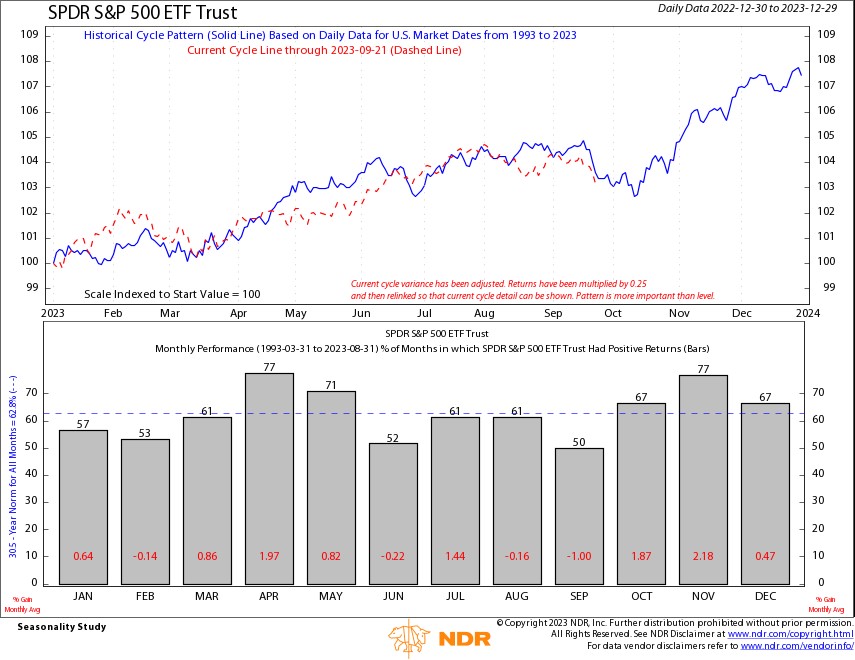

Below is the seasonal chart of the S&P 500 since 1928. The blue line is its seasonal pattern, and the red dashed line is how the S&P 500 has traded this year. It’s not unusual to see some weakness in August and September.

The bulk of the seasonal weakness is typically over by the end of September. If it continues to follow the seasonal script, we should see an end to the seasonal weakness over the next week or so. Other cycles we track suggest it could be as soon as early next week.

*Source: Ned Davis Research

Net-net: We view this August-September weakness as a corrective pullback, not the start of a new bear market decline of 20%+. We raised some cash in our strategies in anticipation of this seasonal weakness and have been slowly putting it back to work in anticipation of a year-end rally as long as our indicators and macro models continue to show limited deterioration.

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.