The markets let out a sigh of relief in early June as Democrats and Republicans in Congress reached a debt ceiling deal. The specter of a U.S. debt default could have wreaked havoc on the global economy and

capital markets. However, once the dust settled, the debt ceiling wasn’t raised but merely suspended until Jan 1, 2025, after the next U.S.

Presidential election in November 2024.

Although House Speaker Kevin McCarthy announced the presence of non-defense, discretionary spending cuts, total federal spending is projected to stay elevated at $6.2-6.3 trillion, which is $1.8 trillion more than the $4.5 trillion spent before the onset of the Covid pandemic in 2020.

The crux of the debt deal is that the US government will still run deficits of $1.5-1.6 trillion over the next two years, maintaining a highly stimulative fiscal policy. This stands in contrast to the 2011 debt ceiling

compromise between President Obama and House Speaker John Boehner that led to overall cuts in government spending. The aftermath of that deal triggered a continued sell-off in the stock market,

culminating in a 20% drop.

Although fiscal policy will provide a boost for the economy and markets, monetary policy will become more restrictive as the US Treasury refills its reserves that were depleted during the debt ceiling negotiations

to pay the country’s bills. This implies that the Treasury will sell $800-900 billion worth of Treasury securities in the coming months, draining this amount of liquidity from the financial system.

Gauging this impact on markets is challenging, but as of now, we are

observing minimal distress in the risk metrics we track, even after the Treasury sold an estimated $100 billion worth of government securities in the second week of June.

The liquidity drain coming from the Treasury is in addition to the $1.1 trillion being withdrawn by the Federal Reserve’s Quantitative Tightening (QT) program. Consequently, monetary policy will continue to act as a

headwind for markets in the months ahead. So, there are cross currents at this point in time. The situation is unusually complex and further muddled by mixed economic signals on the US economy.

If you have even a cursory experience with ChatGPT, you have a sense of the enormous potential and broad impact on society and business that artificial intelligence (AI) will have. Here are some recent examples:

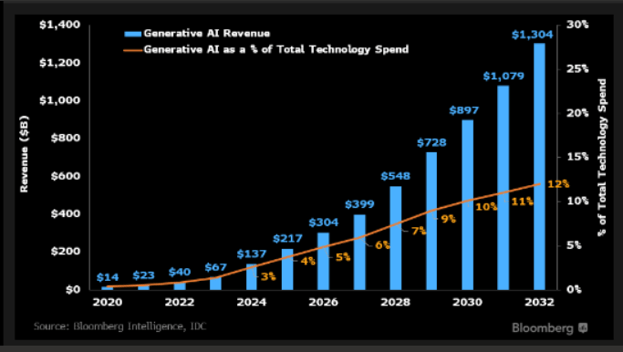

As illustrated in the chart below, Bloomberg Intelligence predicts that total AI spending will rise from $67 billion in 2023 to $1.3 trillion over the next nine years, a compound growth rate of 39% per year.

*Source: Bloomberg

We have studied the key players in this emergent technology and have owned several of these companies in our strategies for some time while selectively adding some new positions in less obvious and still reasonably valued areas. The primary “hyper-scaler” technology companies, with their high-quality databases and resources to harness the technology, are generally regarded as the early winners:

Further investment opportunities will emerge in the cybersecurity arena as AI presents new threats, the extent of which can't yet be fully comprehended. More opportunities will arise from the "pick-and-shovel" plays that develop the next generation of networks to accommodate AI's increased workloads and computational demands.

Although some of these AI investments are currently short-term overbought, it’s still “early days” for this new wave of technological advancement.

John Chambers, the previous Chairman of Cisco (ticker: CSCO), reiterated in early June that AI is still in its infancy and that the majority of the revenues for these kinds of multi-year, disruptive technology trends, like

the internet for CSCO in the late 1990s and 2000s come well after the early stages.

However, if AI proves to be anything like the internet, stock prices will inflate and discount a large portion, if not all, of that potential well ahead of the final years of the revenue “gold mine.” To illustrate this, CSCO:

So, despite the early days' revenues being minor compared to what was eventually realized over the total trend for CSCO, its stock more than fully discounted that well before the bulk of those revenues came through.

For reference, at its March 2000 peak, CSCO sold for 45x sales vs. the 24x sales valuation at which NVDA is currently trading. The Nasdaq-100 is presently selling for 4x sales compared to over 10x at its peak in March 2000, suggesting the AI investment wave has room to run.

The rapid pace of AI advancement may prompt the market to “look through” a significant portion of any earnings slowdown that may come from a possible US recession later this year.

A critical factor in overall market performance will be if the narrow rally this year can broaden. So far, the S&P 500 Index is up 13% (after losing 18% last year), but the average SPX stock is only up 3%, while the Dow Jones Dividend Index is down 5% year-to-date.

If the AI Tech surge broadens, it’s a potential “risk-on” signal and a positive for markets. If the market continues to narrow, we could face problems ahead.

Other positive factors include a robust US labor market, with the US unemployment rate at a mere 3.7%, close to a 50-year low. In addition, most foreign developed and emerging market countries are not currently in recession. The most severe bear markets are typically associated with

synchronized global recessions.

While we are encouraged by some initial signs of the market broadening out thus far in June, we will continue to rely on our objective indicators and models to guide our process based on the weight of the evidence.

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.