The Fed raised short-term interest rates again on May 3rd by 0.25% to a range of 5.0-5.25% in a continued effort to reduce inflation towards its 2.0% goal.

The US economy decelerated during the first quarter, with GDP growth falling to 1.1% vs. the 2.6% reported for the fourth quarter of last year. The Bloomberg consensus of blue-chip economists expects growth to continue to slow to only 0.1% in the second quarter before registering two successive quarters of negative GDP growth in the third and fourth quarters, the standard definition of a recession.

The latest Survey of Senior Loan Officers showed that 46-47% of bank respondents reported tighter lending standards, which are high readings associated with past recessions. Another concerning aspect of the report was that the demand for loans all but evaporated as loan officers reported a 56% plunge in loan demand from small firms. This level of decline in loan demand hasn’t been seen since the 2008-09 Financial crisis.

Bouncing Growth Stocks and Bonds

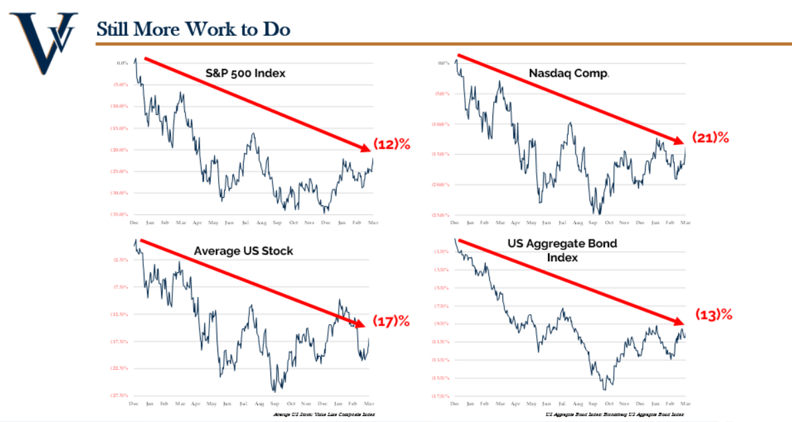

While major indices bounced in the first quarter, they remain well below where they were at the start of last year. For example, after a 33% decline last year, the Nasdaq needs a 48% gain to recoup last year’s loss compared to its 17% bounce in the first quarter of 2023. Similarly, after falling 18% last year, the S&P 500 will need a 22% gain to recoup its loss vs. the 7% bounce it saw in the first quarter of 2023. As shown in the graphic below, all major indices still have more work to do to dig out of the losses from 2022.

Source: VGA-data sourced through Bloomberg

The collapse of three significant banks in 2023 led to an industry-wide tightening in lending standards and created a more challenging environment than expected to begin the year.

Only time will tell how many other banks will fail in the months ahead. Still, Silicon Valley’s demise was an extreme example of interest rate mismanagement by its executives. While other banks invested in long-term bonds when interest rates were unusually low, a decision Warren Buffett has called “really dumb,” the industry as a whole did not do it to the same extent as Silicon Valley.

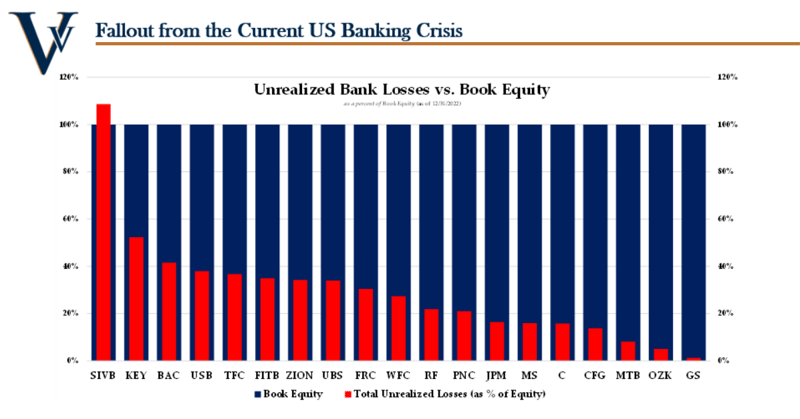

As shown below, the unrealized losses from Silicon Valley’s bond portfolio (red bar) were allowed to increase to more than its entire net worth (blue bar). They would have become insolvent if forced to sell their bonds to meet depositor withdrawals. Notice how other banks also have unrealized losses, but they are generally much smaller than Silicon Valley.

In response to the bank failures and subsequent depositor withdrawals from other regional banks, the Federal Reserve developed a loan program in March to help protect banks from having to take unrealized losses on their bond portfolios to meet depositor withdrawals. This loan facility curtailed a broader run-on bank deposits. While this has stemmed the immediate crisis, lingering concern over depositor withdrawals has caused banks to pull back on lending activity that many small and medium-sized companies depend on.

The stock market has been range-bound since the late fall of last year – frustrating both Bull and Bears alike - reflecting headwinds from the banking crisis fallout, liquidity contractions from the Fed, and nervousness over the US debt ceiling showdown.

Positively, headline inflation continues to decline, and the first quarter earnings were better than feared. More than two-thirds of companies exceeded revenue and/or earnings forecasts, and more companies are raising vs. lowering guidance. As a result, stocks, in aggregate, reacted positively to their first-quarter earnings reports. You would not expect that if an earnings apocalypse was on the horizon.

So, where do things stand?

The banking crisis threw a curveball into the investment backdrop. More bank failures are likely, and tighter credit conditions raise the possibility of a recession this year. Moreover, the Fed has paused its interest rate hikes but continues to drain liquidity out of the financial system. Both of these conditions are headwinds for stocks. Additionally, the US debt ceiling showdown will likely continue adding uncertainty and volatility to markets in the weeks ahead.

Positively, the global economy remains relatively strong, and first-quarter earnings and guidance were better than expected. Inflation continues to come down, and the markets are proving resilient in the face of bad news.

Our macro indicators are not yet showing the bullish consistency we need to give the all-clear signal and become more aggressive with our strategies. Therefore, as risk managers, we maintain elevated cash levels and some hedging until the backdrop becomes clearer.

We still think further downside on the order of 5-10% is possible should the debt ceiling showdown escalate negatively, and we want some extra cash in place as “dry powder” to take advantage of the potential for lower prices. We will need to see the profile of any further sell-off to gauge the market’s health, but we are encouraged by the limited distress currently being seen in a wide range of risk metrics we monitor.

While additional challenges lie ahead, including problems in the office portion of the commercial real estate market, the scale of the current banking crisis is not on the order of the subprime mortgage debacle that caused the Global Financial Crisis of 2008-09.

As always, our process will continue to follow the weight of the evidence from our objective indicators and models. However, our current thoughts are to view a 5-10% pullback as a significant buying opportunity in what should be a better year for investors in 2023.

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.