Late last week, Silicon Valley Bank (ticker: SIVB), a California-based bank that caters to the technology venture capital sector, failed. Concerns over fallout to other banks caused a decline in the stock market, as the S&P 500 lost 4.5% and the Nasdaq lost 4.7% for the week.

While SIVB’s failure will go down as the second-largest bank failure in US history, its implications for the rest of the banking system may be limited, and its impact on markets may be short-lived.

Silicon Valley was a mismanaged bank that saw rapid deposit growth from technology employees, owners, and investors who monetized portions of their companies over the past 2-3 years through public offerings or venture capital cash infusions.

SIVB invested these deposits into long-term US Treasury and Agency bonds that lost value as the Fed hiked interest rates over the past 12 months. Long-term bonds always lose value as interest rates increase.

While other banks have done a similar thing, SIVB did it to a much larger degree on top of a non-sticky depositor base that was 85% uninsured (FDIC deposit insurance maxes out at $250,000 per account). As concerns over the health of SIVB rose, their customers withdrew $42 billion in two days. The bank failed due to an inability to meet these withdrawals since raising cash by selling its long-term bonds would have forced them to realize losses that would have wiped out all the bank’s equity.

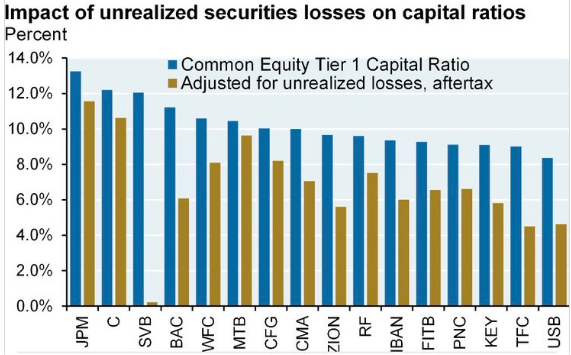

The size of the unrealized losses on SIVB’s bond portfolio relative to its equity was unique among banks. The following chart shows the reduction in common equity (tan bars) from where it is currently (blue bars) should these longer-term “hold-to-maturity” bonds be sold among a sample of banks.

As you can see, given the size of SIVB’s bond portfolio, the losses would wipe out all its common equity. There is little to no risk in these US government and agency bonds if they can be held to maturity, as the holder will get their principal back. Unfortunately, SIVB owned too much of them on top of having a jumpy, niche depositor base that withdrew money at an alarming rate.

Source: J.P. Morgan

Our research suggests there is a strong possibility that SIVB may eventually be viewed as an isolated event rather another major credit crisis that leads to a severe bear market. We will likely not see continued fallout among other banks.

We did, however, see some modest deterioration in our models on Thursday & Friday and raised some extra cash and implemented a small hedge position in accordance with our discipline.

We should see markets stabilize in the days ahead as SIVB becomes viewed as idiosyncratic not systemic. That said, we will continue to monitor the many key risk metrics in our macro models that will either confirm that viewpoint or suggest that the risk of contagion is escalating. If the markets can’t stabilize soon, we see likely see further deterioration in our models and we will adjust our strategies accordingly.

-VGA Investment Team

Vineyard Global Advisors offers a range of investment strategies designed to allow participation in the market's growth within a dynamic, risk-managed framework that seeks to protect against significant market declines. Our goal is to give our clients greater peace of mind by generating steadier returns over time. Contact us to learn more.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.