Superbowl advertisements are fantastic. This year didn’t disappoint. One stood out to us that featured a man wearing headphones and a velour tracksuit- dancing to his music before a public fountain. The ad was for a tax-prep service emphasizing that you can do anything you want (dancing!) if you let someone else handle the hard stuff.

It stood out because it was funny because of the creative dancing and fashion choice. But it also drove home the feeling of freedom that comes from hiring a professional to handle the business of managing your finances.

We all work hard, and we perform our due diligence on how best to manage our investments. Sometimes we throw our hands up in overwhelm because the stock market isn’t what it used to be. Things got tricky when the Fed decided to deflate the valuation bubble. Knowing how to manage the resulting volatility has become a challenge.

Let’s examine the importance of a risk-management mindset and learn why drawdown parameters are the best way to manage your exposure. Finding a team to help you manage your risk will help you sleep better, so you can spend more time and energy working on those rad dance moves.

Drawdown Parameters

Drawdown parameters refer to the percentage decline in the value of an investment from its peak. For example, if an investment has a drawdown parameter of 10%, it means that the investment can decline by up to 10% from its peak before triggering a signal for action. Drawdown parameters are important because they help investors and managers set realistic expectations for managing risk exposure and are an essential safety feature when planning for your financial future.

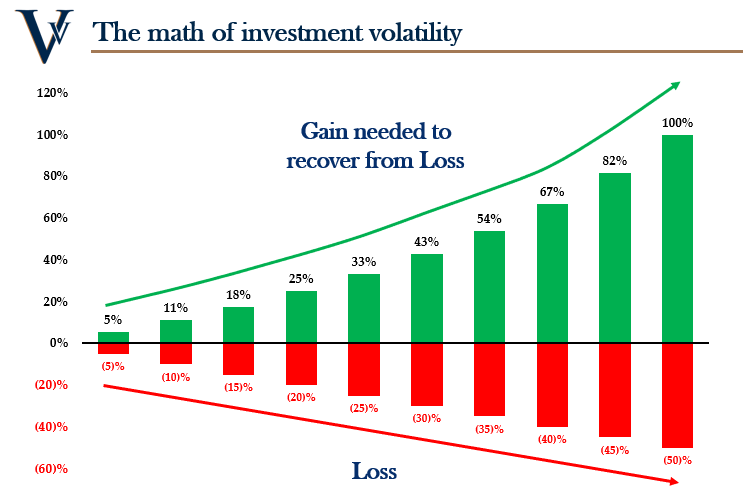

Limiting loss is essential because the time it takes to recover from a drawdown can be exponentially higher than the time it takes to drop. It is also important to note that you will need to gain more than you lose to recover from a loss. That is why Vineyard Global Advisors embraces a higher lows, lower highs investment philosophy.

For example, if you have a loss of 45%, you will need a gain of 67% to recover, thanks to the math of investment volatility.

Risk Management

Risk management is the process of identifying investment risk and determining the best way to address it. The goal is to keep potential loss within an acceptable range based on your own tolerance and investment goals. We practice risk management daily, wearing a seatbelt when driving, locking our front doors, and purchasing insurance.

Protecting your investments should be no different. Risk is inseparable from return. However, some challenges must be faced, and knowing where you are on the risk tolerance scale and where you are in the investor's lifecycle will help you determine what type of parameters to set. Know your boundaries. Every investor has a unique investor profile with different levels of risk tolerance and time horizons.

The key to managing your boundaries is to adopt an agile strategy and process, allowing you to react quickly to market volatility and take part in opportunities that align with your overall strategy while managing your exposure.

It may sound overwhelming! But let's think back to that glee-filled dancer at the fountain. He might have just hired a manager, a professional who thrives in a volatile marketplace, to handle his risk parameters. That is why he is dancing.

“At VGA we’ve “walked the talk” of risk management. After participating strongly in 2021’s bull market, we managed this year’s bear market well, which will continue to pay rewards for clients as the market recovers into 2023 and beyond.”

A good risk management strategy can involve diversification, position sizing, stop-loss orders, and so much more. These strategies are best employed by an experienced manager, who does this daily regardless of market conditions.

Everyone is different, and your manager knows one size does not fit all. Therefore, your risk management should be managed uniquely, just like you. Minimal downside risk is a universal desire, but the strategy needs to match the desired outcome. A manager can be an invaluable partner in this goal.

Risk management is all about having boundaries and parameters. Therefore, when using drawdown parameters, you are actively practicing a risk management mindset which allows you to get off the emotional roller coaster of investing.

Finding an experienced manager is critical—even better, a manager who thrives in a volatile marketplace. VGA offers a range of investment strategies designed to allow market growth participation within a dynamic risk-managed framework that seeks to protect significant market declines. Our goal is to give our clients greater peace of mind by generating steadier returns over time using a data driven approach.

You Might Also Like:

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.