Finding those proverbial sweet spots are essential for a happy life. It may be your favorite recliner where you watch football or the morning after a snowstorm - fresh powder waiting for your tracks. Perhaps it's hearing your favorite song or glimpsing your children loving each other. Sweet spots give us joy and comfort; they just feel right.

We are always focused on finding the sweet spot for our investors at Vineyard Global Advisors. Our range of investment strategies is dynamic and seeks to offer protection during significant market declines while allowing for participation in the market's growth.

Steadier returns over time make for balanced emotions and peace of mind. From an investment standpoint, you might give up some upside potential to benefit from downside protection during declining market backdrops. Yet, this balance will help protect your equity and is the basis of our investment philosophy of higher lows and lower highs.

A Risk-Managed Framework

Humans are good at survival. Think of all the ways we work to protect ourselves and manage risks: fire alarms, fire escapes, dams and levees, tornado shelters, and life preservers. In addition, we rely on drills, tests, warnings, and sirens to keep us alert. Preparing for scary stuff makes us less afraid, and the same planning should also apply to your assets and investment portfolio.

Finding your own investment sweet spot might take a few tries. You may have waited too long to unload some of that tech stock, or you sold too much too soon. Hindsight is 20/20. It's human to kick yourself for missed opportunities or delayed reactions.

One of the best ways to achieve your goals is to take emotion out of the investment equation. Partnering with an investment advisor or manager who utilizes investment risk management strategies will help you achieve your long-term financial goals using flexible, data-driven techniques.

Look for a manager who offers:

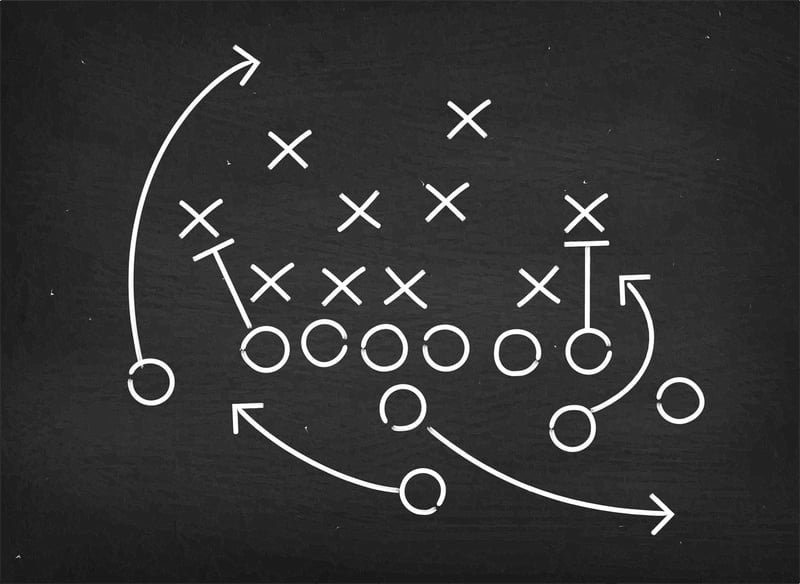

Find a manager skilled at building portfolios prepared to play defense and offense because both components are essential for creating a path to meeting your investment objectives. Learn more about risk managed investment strategies.

The Importance of a Good Defense

Watch any sport, and you’ll find excellent examples of defense. No team will just let their opponents charge down the field unchallenged. Your investment portfolio and assets should be managed with the same attention to protection as any defensive coordinator in the NFL. Survival and success rely on preparedness, awareness, and defensive action.

VGA strives for higher lows and lower highs through a dynamic risk-managed framework. Clark Richard, VGA's co-founder and CEO, recently commented,

"When the markets go down, if we've done our job correctly, we have a lot less downside volatility than the markets overall. We increase the hedge. Take our Russell 3000 enhanced dividend strategy - 75% of that portfolio is allocated to high quality dividend paying stocks. 25% is left in this hedge.

When we feel that the backdrop has deteriorated and we want to play more defense, that hedge can be adjusted so that we make the whole portfolio look like 25% stocks. So, we increase the short exposure of that hedge to bring down the net exposure to 25% - when we feel that the backdrop is advantageous to the investor.

We slowly increase that hedge and could get all the way up to 125% net long exposure for the client. Over time, when we see things getting worse, we bring more defensive players on the field. And then as the storm passes, we start slowly bringing more offensive players back on the fields.

If we are down in the single digits, we don't have very far to go to start making money for our clients.”

It comes down to knowing when to move those defensive players onto the field and mitigate some of that downturn. It is about protection and timing.

Finding the Balance

Markets will rise and fall. Finding the balance between the two extremes is what lower highs and higher lows is all about. You will find that having a plan and a partner will make all the difference.

Vineyard Global Advisors offers a range of risk-managed investment strategies designed to allow participation in the market's growth within a dynamic, risk-managed framework that seeks to provide protection during significant market declines. Our goal is to give our clients greater peace of mind by generating steadier returns over time.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.