Last week, the Case-Shiller US Home Price Index fell by a whopping 9.8%, its most significant decline in over ten years. In addition, the Fed’s interest rate hikes have reduced housing affordability by causing mortgage rates to soar to 7.2%, the highest level in over 20 years.

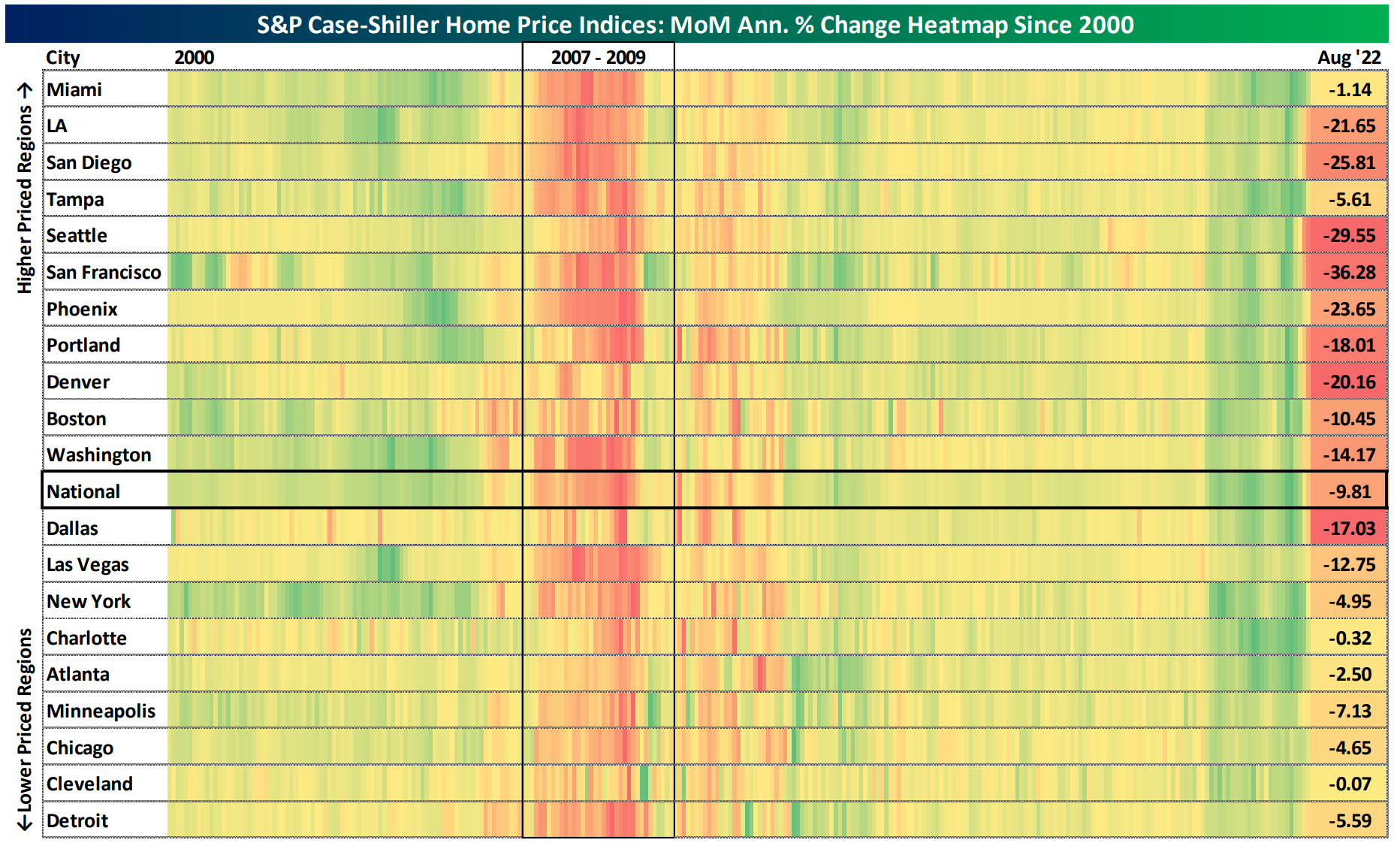

The Case-Shiller index measures 20 different US metro regions, and the heatmap below shows that many of these regions saw their sharpest home price declines since the 2008-09 Global Financial Crisis in August of this year (August 2022 price declines are on the far right, red shading represents monthly declines, green shading monthly increases).

Source: Bespoke .

Source: Bespoke .

While US consumers have enjoyed the increase in their home values over the past 12-18 months, soaring home prices have increased the cost of shelter that flows through to inflation, reaching 40-year highs. After bringing down unemployment to only 3.5%, the Fed is now focused on bringing down inflation. To do so, they have to reduce the cost of housing since shelter prices represent the largest share of the Consumer Price Index (CPI), the key measure of US inflation. Rapidly rising home prices also make consumers feel wealthier and more inclined to spend - even more so than seeing the value of their 401(k)’s increase - and the Fed wants to slow down consumer spending to reduce demand and give supply a chance to catch up.

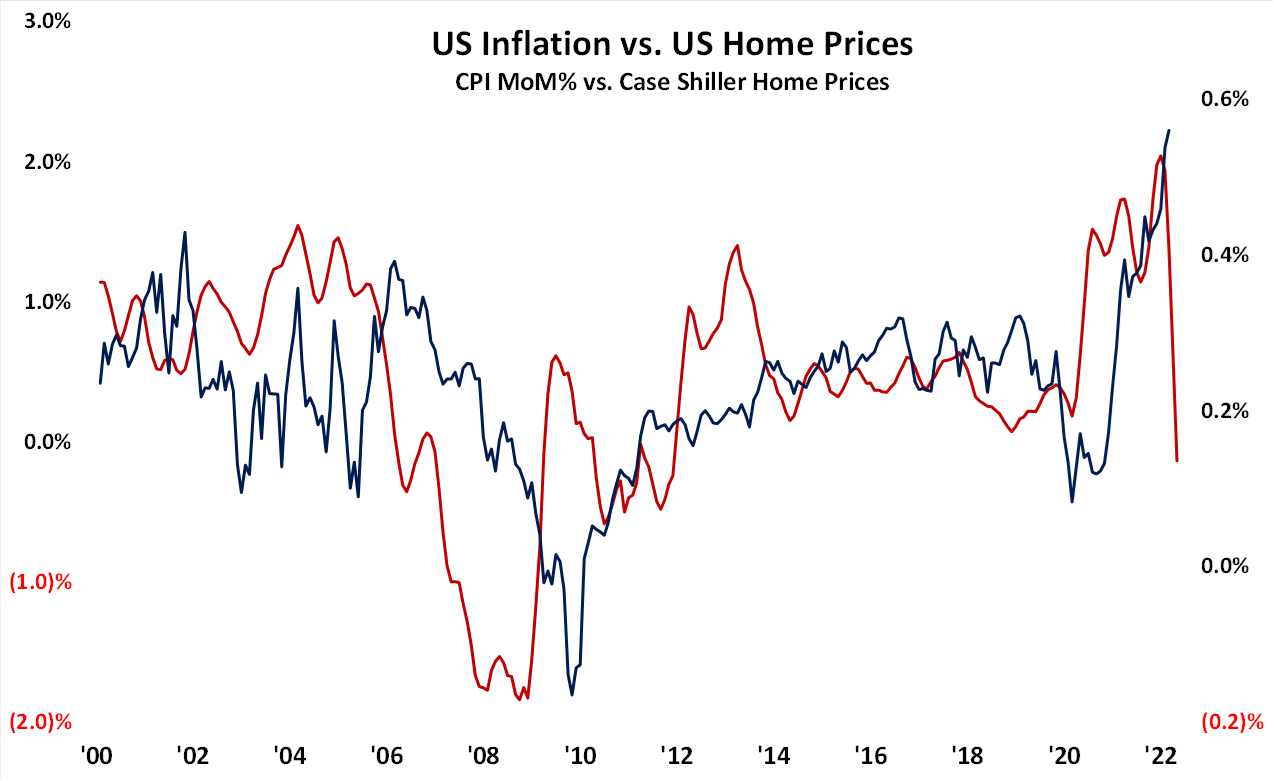

The good news? As shown below, when home prices come down (red line), it eventually contributes to lower inflation (blue line), albeit with a lag.

![]()

*Source: Bloomberg, US Bureau of Labor Statistics

As we noted in our third quarter webinar, several forward-looking measures of inflation have already started to come down, suggesting that the reported inflation figures the Fed sets policy on will likely eventually follow suit.

Inflation “breakevens” now show that inflation is expected to subside to less than 3% over the next year. While that could be explained away by the escalating possibility of a recession over the next 12 months, inflation expectations looking out 2, 3, 5, and even 10 years are also less than 3%. Finally, the 10-year US Treasury Bond yield remains low by historical standards at only 4.1%, very different from the 10-15% rate that existed in the latter half of the 1970’s when inflation was a prolonged and systematic problem.

The upshot is that if inflation subsides in the first half of next year, the Fed will likely pause or reverse its aggressive pace of interest rate hikes since March of this year, which have pummeled stock prices, setting up a much better year for investors in 2023.

As always, we will follow our objective indicators that warned us of a deteriorating investment backdrop back in January of this year, causing us to maintain defensive positioning for all of 2022 after a bullish backdrop from the Covid crash low in early 2020 through the end of 2021. As our indicators pick up on an improving inflation picture, we anticipate a more favorable environment for investors and will adjust our strategies accordingly.

The VGA Investment Team

11/1/22

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.