2021 has been a good year so far for U.S. investors with the S&P 500 rising 18.6% through September 15th. The 2021 gains have also come with limited downside volatility, as the maximum pullback this year has only been 5.8% compared to the average intra-year decline of 14% since 1980.

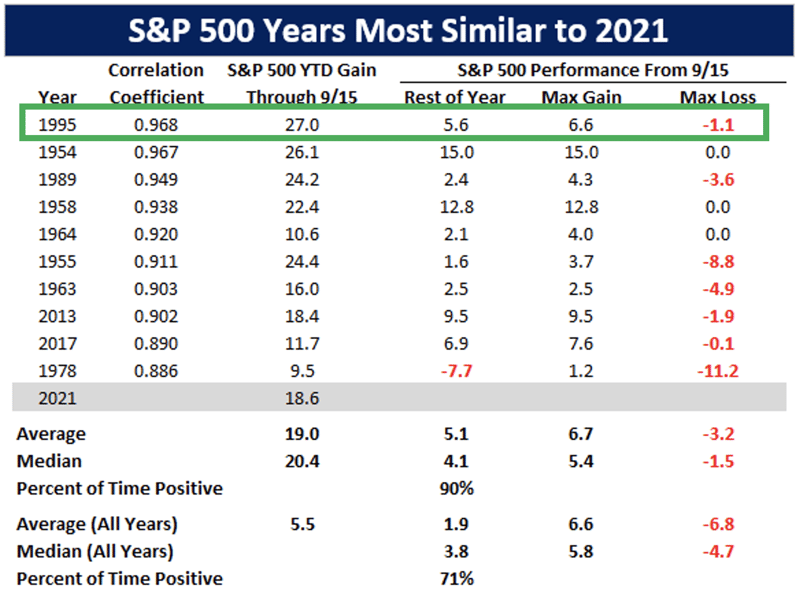

The table below shows the top ten years that are most correlated to 2021’s year-to-date performance. The years are ranked according to their similarity with 2021 (from highest to lowest). Historically, years like 2021 have gone on to post a further 5.1% gain through year-end, with positive returns in 90% of the cases.

So, the analogs to 2021 support the old stock market adage “strength begets strength”, which we discussed in our second quarter review.

Source: Bespoke

Source: Bespoke

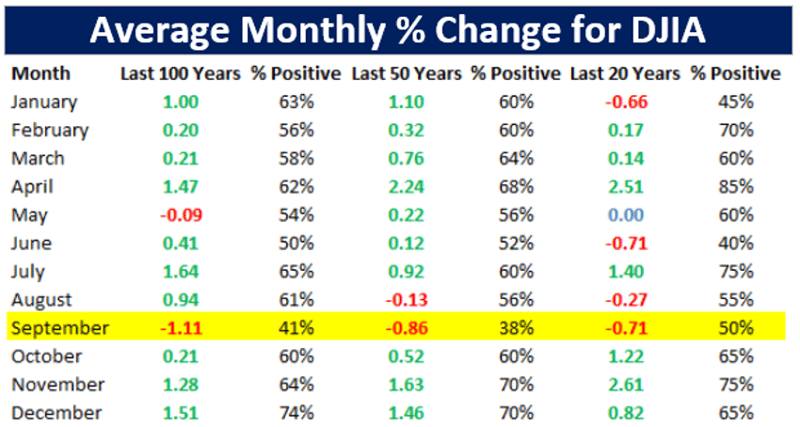

However, we have seen many stocks stall out over the past 2-3 months and post declines thus far in September causing some investors to question whether the bull market is ending. For some perspective, it’s important to remember that pullbacks in September are not at all unusual. In fact, from a seasonal perspective, September is the only month that has averaged a decline over the past 20, 50 and 100 years as shown below.

Source: Bespoke

Source: Bespoke

For some additional perspective, we have already seen seven pullbacks during 2021 ranging from 3-6% compared to the 2.4% intra-month decline so far in September. So, even compared to a low volatility year like 2021, what we are seeing in September has been fairly tame.

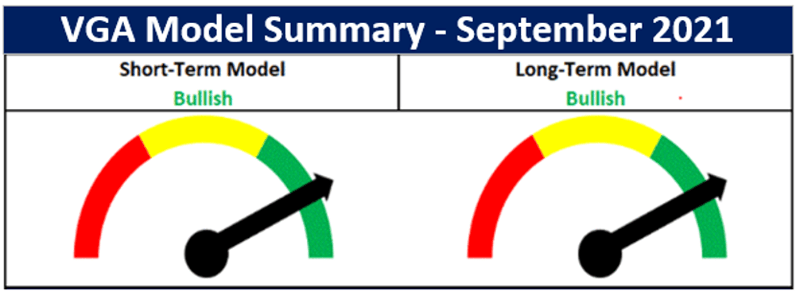

Most importantly, in terms of our investment process, VGA’s macro models have remained bullish throughout this year’s September weakness, deciphering the downside volatility as ‘normal’ and within the confines of a continued longer-term uptrend. This is in stark contrast to the broad-based indicator deterioration we saw during initial stock market declines in the fall of 2018 and just before the Covid Crash of last year, which alerted us to raise defensiveness due to the likelihood of much greater downside.

Given our bullish model readings, our strategies remain fully invested to participate in additional upside potential through year-end. As always, should the objective weight-of-the-evidence change, we will reposition accordingly.

We appreciate the trust you have placed in VGA to manage a portion of your wealth and are available by phone or email for any questions or comments.

Respectfully,

VGA Investment Team

Sept 2021

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.