U.S. equity investors have experienced frequent bouts of volatility over the last several years, giving life to the old investment adage ‘good markets aren’t volatile, volatile markets aren’t good’. While this may hold true at certain points in time, it is important to understand what to expect in terms of ‘normal’ market volatility that investors will experience in any given year.

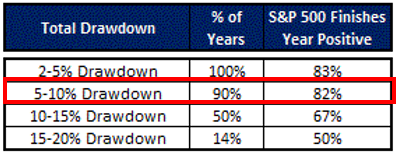

In almost every calendar year the stock market experiences a 5-10% intra-year drawdown. They can & should be considered ‘normal’. As illustrated in the first table below, 90% of all years since 1980 have experienced at least a 5-10% intra-year drawdown. Despite these intra-year declines, nearly 80% of those years continued to finish the calendar year with positive returns.

Source: Bloomberg

Source: Bloomberg

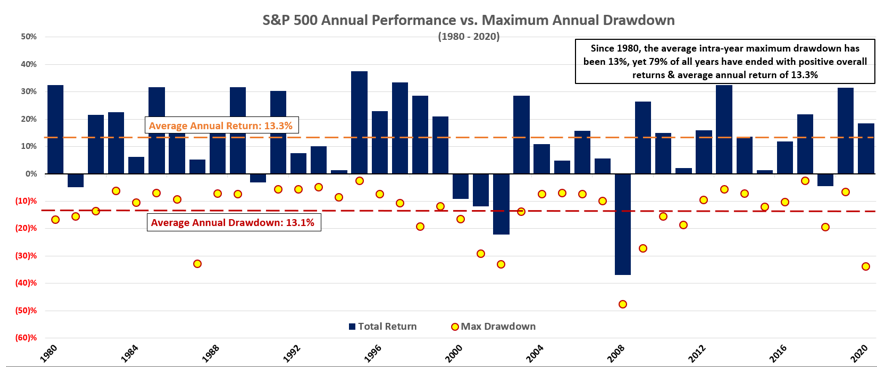

Furthermore, the next chart below shows calendar year returns for the U.S. stock market since 1980, as well as the largest intra-year drawdowns that occurred in each year. During this period (1980-2020), the average intra-year drawdown was 13%. Despite having to withstand this ‘normal’ volatility, investors were rewarded with an average annual return of 13.3% & 79% of years finishing positive.

Source: Bloomberg

In spite of 5-10% intra-year drawdowns being ‘normal’, every bear market begins with a 5-10% decline. Therefore, it is important to be able to distinguish between ‘normal’ volatility and the type of volatility that is likely to escalate into a stock market crash and/or severe bear market. At VGA, we follow an objective ‘weight-of-the-evidence’ process, with proprietary indicators & models that are designed to differentiate between ‘normal’ market volatility & noise that occurs in any given year from conditions that may lead to something more damaging for investors.

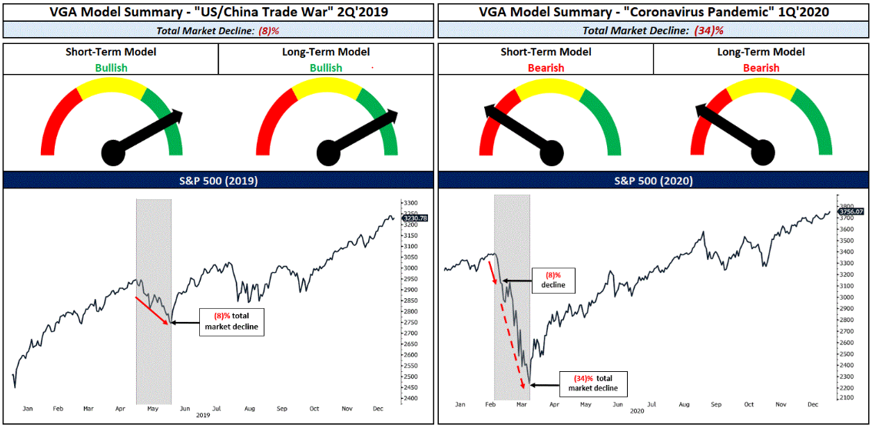

To help illustrate this point, we have included two contrasting time periods from recent history. The first period is from the 2Q’2019, which saw the escalation of the U.S. / China Trade War. The second period is from the 1Q’2020, which coincided with the upsurge of the Coronavirus Pandemic. As you can see, the U.S. / China Trade War (left) saw a ‘normal’ market decline of 8% versus the Coronavirus Pandemic (right) total decline of 34%. VGA’s models remained bullish throughout the first scenario, correctly deciphering the volatility as ‘normal’. Alternatively, the second scenario saw VGA’s models turn decisively bearish & correctly signaled the start of a deeper decline that warranted increased protection & hedging.

Source: Bloomberg

Source: Bloomberg

Knowing what to expect as well as correctly identifying environments that exhibit ‘normal’ volatility is paramount to continued investment success. The VGA Investment Team is prepared with our objective ‘weight-of-the-evidence’ indicators & models to help our clients navigate through turbulent times & continue to grow and preserve their wealth.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.