The market remains concerned about stretched valuations and a repeat of the dot-com bust of 2000-03 when the S&P 500 lost over 50% of its value. However, major indices have just recently recouped their considerable bear market declines of 2022, and historically, the stock market has shown a strong tendency to continue to rally after a bear market decline is fully recouped vs. rolling back into another bear market decline of 20%+.

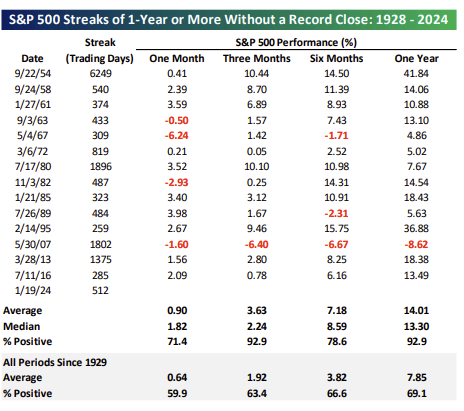

As shown below, since WWII, the S&P 500 has gone on to post an average 14.0% gain after a 1-year or more streak without a record close has ended (as it did on 1/19/24 when the 18% decline in the S&P 500 was finally recouped). As shown by the far right column, the S&P 500 posted positive returns in 13 out of 14 instances (93%) one year later. The only instance where it didn’t was during the Global Financial Crisis of 2007-2009, the equivalent of a 100-year storm.

Source: Bespoke

Source: Bespoke

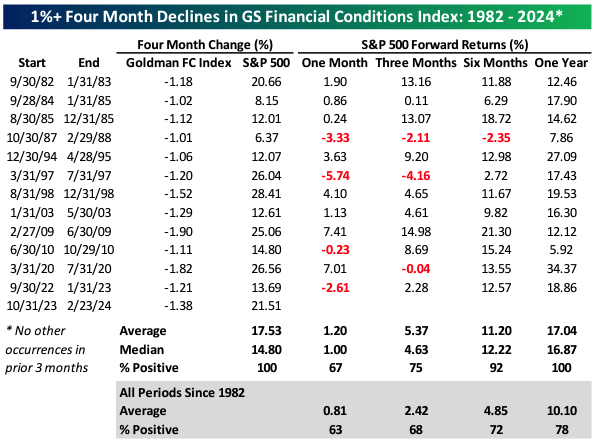

Looking closer at the one instance where the S&P 500 was lower one year later (during the GFC), the rapid deterioration in financial conditions as subprime mortgage loans failed during that episode was flagged by numerous risk metrics, which is not the case currently. For example, Goldman Sach’s Financial Conditions Index (GSFCI) - a daily update on US financial conditions - is not flagging crisis level financial stress currently. Quite the opposite. It has recently shown a high level of improvement (or loosening) in financial conditions over the past four months. As shown in the table below, the GSFCI has only fallen (lower = improving or loosening) 1% or more thirteen times since 1982, and in every single instance, the S&P 500 has been higher 6 and 12 months later, by an average of 11.2% and 17.0%, respectively. Both averages are considerably better than the average of all 6 and 12-month periods since 1982 of 4.9% and 10.1%, respectively.

Source: Bespoke

Source: Bespoke

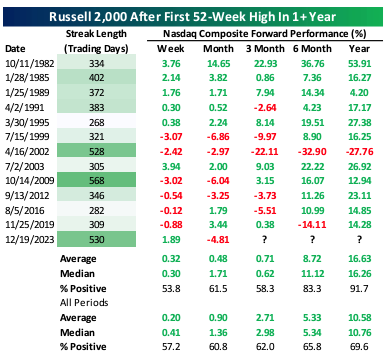

Looking at other major stock market indices, like the US small-cap Russell 2000 index, a similar strong tendency towards further gains is seen. As shown below, the Russell 2000 index, has gone on to post a 16.6% gain one year after failing to hit a new high in the past year in 11/12 instances.

Source: Bespoke

Source: Bespoke

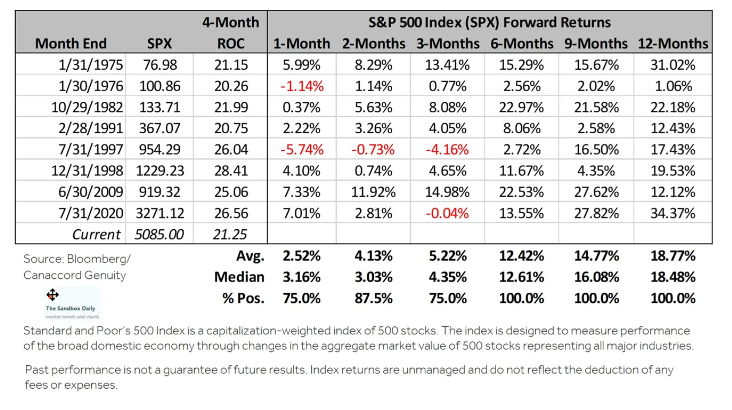

Finally, not only has there been a strong tendency towards further gains after a bear market decline is recouped, but other analogs looking at the consistency and strength of four-month gains also suggest the market is on solid technical footing. As shown below, once the 4-month rate of change of the S&P 500 exceeds +20% (as it just has), forward returns have been positive in every single instance since 1975 over the next 6, 9, and 12 months. The S&P 500 has gone on to gain 12.4%, 14.8%, and 18.8% on average over the next 6, 9, and 12 months, respectively.

Sources: Bloomberg, Canaccord Genuity, Grindstone

Sources: Bloomberg, Canaccord Genuity, Grindstone

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.