We suggested putting on your seatbelts as we entered 2022 (VGA Q4 Webinar) since we thought stock market volatility would increase dramatically this year due to renewed geopolitical turmoil plus concerns over inflation and the upcoming Fed tightening cycle. We haven’t been disappointed!

Right now, Russia’s invasion of Ukraine is front and center, which has stoked fears of WW III should Putin set his sights on conquering other Eastern European countries such as Poland, Hungary, and Romania – all of which are part of NATO and would require the US and its allies to come to their defense should Russia attack them. While news flow is sporadic, the Russian army has met strong resistance from the under-armed Ukrainian forces and is having more difficulty than expected. This Russian set-back has contributed to a bounce in the markets over the past 2 days since it's raised hopes for settlement talks and, more broadly, the perceived ability of much better armed NATO countries to resist any Russian attempts to take them over.

We are monitoring developments closely with particular attention to the message of our objective indicators, which have signaled caution since early this year. Accordingly, we have been well-hedged in our strategies in 2022 (with elevated levels of cash plus small hedge positions) and thus fallen less than major indices. Many of our hedged strategies are off less than 2% year-to-date after posting very strong performances last year.

As always, we will let our indicators guide our investment process. Positively, we have not seen several key risk metrics flash the “hunker-down” signal, so our strategies will remain slightly under-weight relative to their benchmark exposures. Should oil prices spike in the weeks ahead over an escalation of tensions with Russia – raising the risk of a recession – downside on the S&P 500 could be to 3500-3600 (a decline of 27% from its January 2022 high). But our expectation is for a more modest intra-year decline this year of around 20% which would prove to be an outstanding buying opportunity as Fed tightening fears (and the ongoing re-valuation process due to higher interest rates) would be adequately discounted.

In the meantime, flashy bounces from oversold conditions will likely continue to occur within the context of year-to-date declines. Despite the rally of the past 2 days, the S&P 500 is still down (8.5)% and the Nasdaq has lost (13.3)%. These kinds of rallies are not unambiguously the “bell going off” for the bulls. As described below, large “gap-down” days of 3% or more that reverse to post gains by the end of the day were also commonplace during the dot-com bust of the early-2000’s.

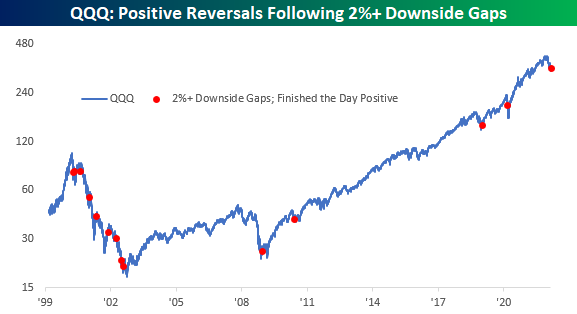

“Yesterday, we noted that the Nasdaq 100 ETF's (QQQ) positive reversal was just the third time in its history that the ETF gapped down more than 3% at the open and finished the day more than 3% higher. The other two days were in April 2000 and May 2001. Neither of those two prior days were followed by positive returns for US stocks. Widening out the criteria a little more, yesterday was only the 14th time that QQQ gapped down 2% at the open and finished the day higher. Once again, the vast majority of prior instances occurred during the dot-com bust, but they weren't exclusively confined to that period, and there have also been a handful of prior occurrences since the end of the financial crisis that occurred late in market sell-offs as well. In other words, the jury is still out, and given the catalyst behind yesterday's downside gap (a major geopolitical conflict) it's probably not a good idea not to read too much into one day's action.”

Source: Bespoke Investment Group

Source: Bespoke Investment Group

Our indicators will eventually distinguish if the current price action is a buying opportunity or a continuation of a broader downtrend, just as they did in early-2020 before the pandemic crash and later that spring by giving the “all-clear” signal. Until then, we expect more stock market volatility and will maintain slightly defensive positioning until a clearer picture develops, at which point we will adjust exposures accordingly.

VGA Investment Team

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2024 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.