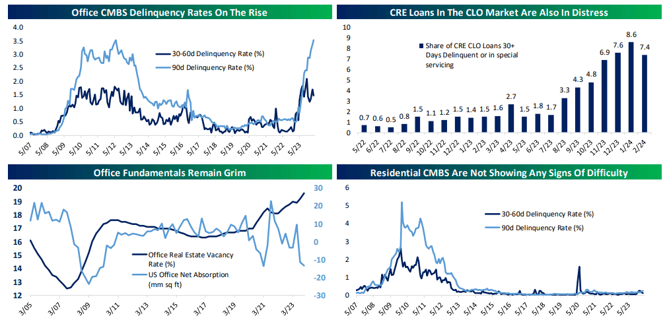

Commercial Real Estate, especially Office, remains a problem and a potential headwind for markets. Bank of America’s CEO Brian Moynihan called it a “slow burn.” As shown in the charts below, many metrics continue to worsen.

Source: Bespoke

In the lower left, you'll notice office vacancy rates continue to worsen and are approaching 30%. As shown in the upper left, office loan delinquency rates continue to rise. The Atlantic magazine recently pointed out that most office leases were signed before the Covid pandemic hit - when offices were full and interest rates low - and have yet to come up for renewal. An estimated $1.5 trillion in office loans are due for repayment by 2025. Some will be written off, some will be re-negotiated and extended. The exposure is greatest with regional banks as they account for nearly 70% of all commercial property bank loans.

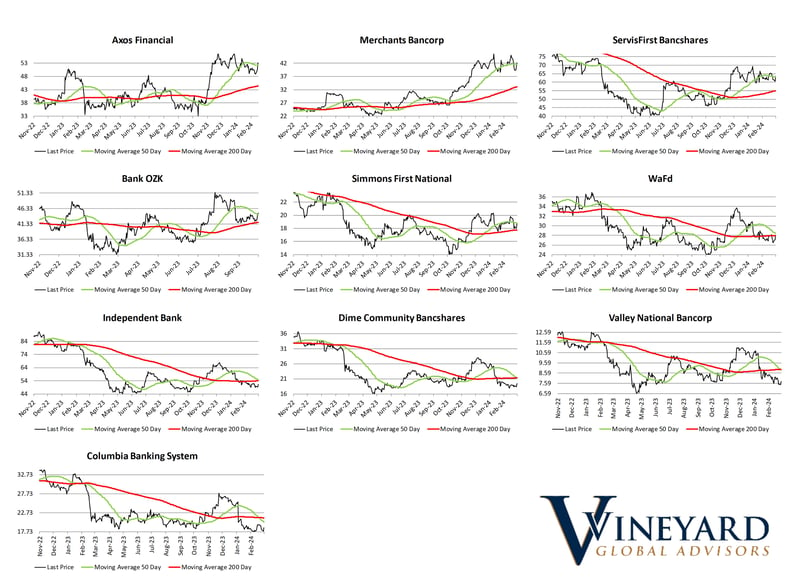

While we continue to see the odds favoring a continuing bull market, the remaining “CON” of Commercial/Office property fallout is a risk we are monitoring from several angles to gauge if (and when) it may lead to broader financial contagion. Positively, we continue to see limited distress in a wide range of risk metrics we track (even after several publications re-iterated the worsening of the CRE problem earlier this week). A recent Barron’s article identified 10 regional banks that are most exposed to CRE. Should their CRE problems escalate, it would further weaken their balance sheets and require additional equity issuance or bailouts. Both would be negative developments for their stockholders and would start to show up in their share prices. So far, the majority of these 10 banks’ share prices are holding up (trading above their lows reached during last year’s regional banking crisis that took down Silicon Valley Bank, First Republic, and Signature Bank.

Sources: Barron’s, Bloomberg

Additionally, the recent breakdown of New York Community Bank (a regional bank with troubled CRE loans) and subsequent capital infusion by former US Treasury Secretary Steve Mnuchin and a group of private investors showed little fallout/share price declines from other high CRE-exposure regional banks. This suggests private market capital may be available if needed and that the market views the CRE problem as currently “containable” and unlikely to trigger another financial crisis.

For now, our indicators and risk metrics agree. We will continue to monitor the CRE/Office problem from numerous angles and adjust our strategies accordingly should it escalate to a level that has broader implications for financial markets.

*All data sourced from Bloomberg

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.