The Fed raised short-term interest rates by 75 basis points this week, lifting its target rate to 1.50% - 1.75%. The 75-basis point increase had been fully priced into the Fed Funds futures market prior to the meeting. Markets initially reacted positively to the news, reversing some of the bearish moves in equities and rates over the past few days.

Fed Chairman Powell offered a continued sanguine view of the US economy saying, “There’s no sign of a broader slowdown in the economy.” The Fed’s economic projections continue to show a recession will be avoided, the unemployment rate will barely rise to 4.1% (from 3.6% currently), and inflation will settle down to only 2.6% next year from current 40-year highs. Great news, right? Everyone keeps their jobs, we won’t have to pay over $100 much longer to fill up, and we can forget about skipping vacations to afford life’s other essentials.

Why then does the market keep selling off?

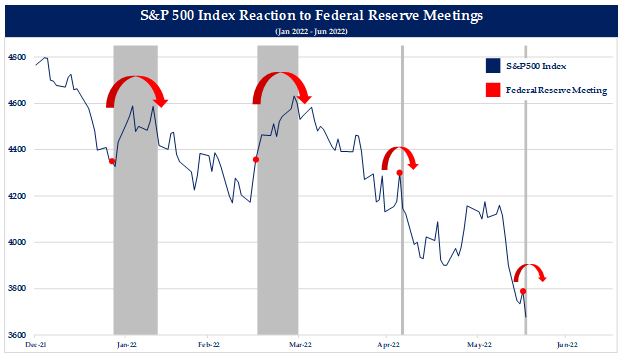

As shown below, the S&P 500 has faded the Fed’s rosy outlook after every meeting this year, continuing its bearish pattern of lower highs and lower lows.

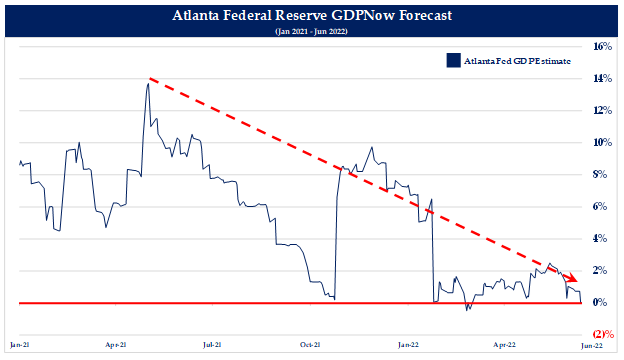

The problem is that Fed Chairman Powell is not acknowledging the economic reality that the US economy is teetering on a recession after posting -1.5% growth in the first quarter of 2022 from over 6.0% in the first half of last year. In fact, the Fed’s Atlanta branch publishes a “GDP Now” report that incorporates real-time incoming data and clearly shows a rapid deceleration in the US economy (see below).

Remember, a recession is two successive quarters of negative GDP growth and we’ve already had one in the first quarter of 2022 and are very close to a second. Many other economic data points point to a broad-based economic decline, including:

JPMorgan points out that the 23% year-to-date decline in the S&P 500 implies an 85% chance of a recession. Recessions matter for investors since stock market declines are typically worse and last longer during recessions

Source: Ned Davis Research

Bottom line: As discussed on our website and in our quarterly calls, we have been concerned about the rampant speculative fever brought on by the Fed’s zero interest rate policy, excessive money printing, and the broad-based economic decline that was likely once the Fed reversed course by tightening financial conditions to combat the run-away inflation it contributed to.

Our indicators picked up on this early in 2022, and all VGA strategies have been defensively positioned after posting strong positive returns last year. We think there may be another 5-10% further downside before risks are adequately discounted but, as always, we will let our objective indicators guide our decision-making.

What this means for our investors is less of a decline or “drawdown” in their accounts to recover from once the bear market runs its course, which will pay big rewards over time. It also means a smoother and less emotional ride on the way toward achieving their financial goals.

VGA Investment Team

Learn more about Vineyard Global Advisors’ investment strategies or to discuss themes discussed in this post,  .

.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.