Major stock indices sold off sharply on the holiday-shortened trading session on Friday over concerns about a new Coronavirus strain, named Omicron, that was initially reported in S. Africa and Botswana but is also showing up in parts of Europe and Hong Kong. The S&P 500 fell 2.2% on Friday, wiping out its November gains. Today markets are rebounding, adding back over 1.0% in gains.

While the total number of Omicron cases is still relatively low, the new variant appears to be more transmissible than other strains of the coronavirus and has more mutations of its spike protein that current vaccines target to contain damage to healthy cells. It remains unclear to what extent current vaccines, antivirals and natural immunity will be effective against this new strain. However, Moderna, Pfizer and BioNTech said they will be able to assess the effectiveness of current vaccines in about two weeks after evaluating the initial results from studies on new Omicron cases.

Positively, both Moderna and BioNTech said that if the current vaccines are not effective, a reformulated vaccine could be developed and available in large supply by early-2022. “The remarkable thing about the mRNA vaccines (the platform used by Moderna) is that we can move very fast”, said Paul Burton, Moderna’s Chief Medical Officer. Additionally, reports over the weekend from two S. African health experts said that symptoms of the new strain have so far been mild, requiring limited hospitalizations.

While more time will be needed to better understand the Omicron challenge to the global economy, the news flow that matters for capital markets in the weeks ahead is:

1) The study results of current vaccines on new Omicron cases (due out in two weeks)

2) Further clarity on the timing of reformulated vaccines (if the current vaccines are not effective)

3) The incidence of Omicron hospitalizations and deaths (as new Covid cases have risen recently, deaths have increased at a slower rate suggesting vaccinations and natural immunity are winning the war against the virus)

4) Will global central banks reverse their pre-Omicron plans to reign in their ultra-accommodative policies that have been in place since last spring? (this could support markets until new vaccines are available and travel restrictions lifted)

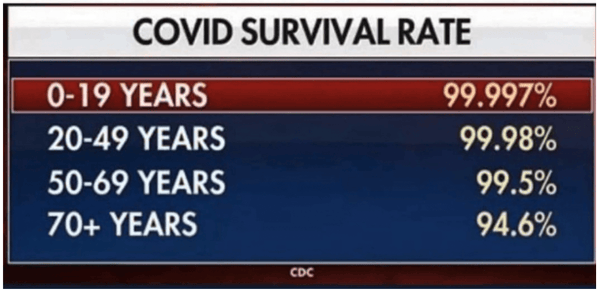

We will monitor the news flow and data over the weeks ahead, but we also think is important to keeps some facts in perspective. Note the survival rate of Covid:

Source: CDC

Source: CDC

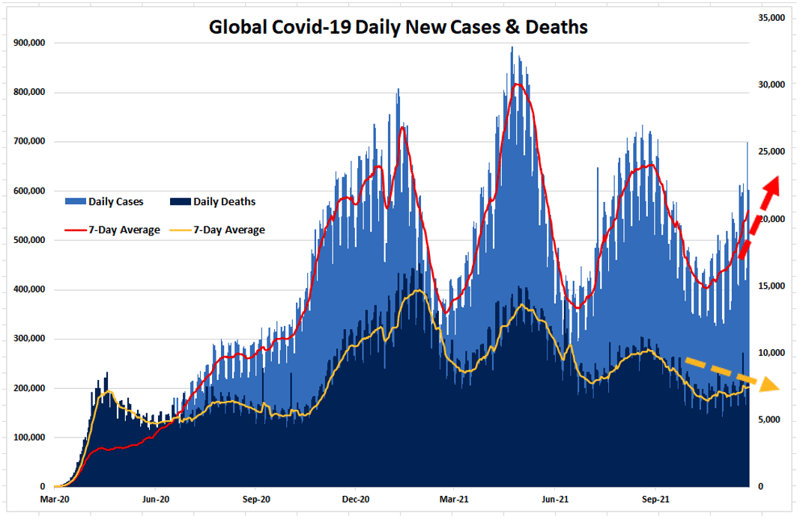

From an investment perspective, new surges in Covid cases (due to each new variant) have caused the stock market to pull back (the most recent example was the 6% sell-off in the S&P 500 in September through early-October of this year). Then, when the case count peaks and subsequently declines, markets regain their footing and go back to rally mode. As we mentioned above, it's also encouraging that deaths have not been rising commensurately with each new surge in covid case counts.

Source: WHO

Source: WHO

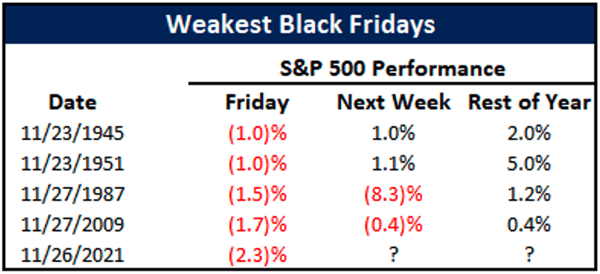

In terms of how we have positioned VGA strategies, we knew the market was short-term overbought before Friday’s sell-off and were expecting a mild pullback of 3-5%. The Omicron news provided the reason for the overdue pullback. If the S&P 500 holds its 50-day moving average at 4528 after a 5% pullback (vs. the 3.4% decline so far from its 11/22 peak), the uptrend would remain intact and we would expect to see limited damage to our objective ‘weight of the evidence’ indicators that guide our investment process. For now, the market is not showing alarming levels of distress and most indices remain in longer-term uptrends. The analogs also continue to suggest a positive finish to the year (see table below).

Source: Bespoke

Source: Bespoke

For now, we are maintaining fully-invested (or bullish) positioning in our strategies, expecting a good finish to the year. However, as always, we will follow our objective indicators and adjust accordingly should the ‘weight of the evidence’ suggest that a more defensive posture is appropriate.

Respectfully,

VGA Investment Team

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.