As discussed in our second quarter 2020 review, we expected the stock market rally that began after the first quarter crash to continue into the second half. Accordingly, we positioned VGA strategies at or slightly above benchmark exposures for July and August. Our strategies have participated in the stock market recovery of the past two months with most of our strategies beating respective benchmarks for both August and the third quarter to date.

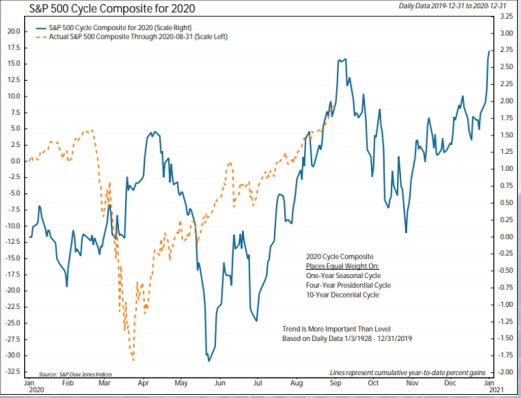

However, we also anticipated raising some cash in the late-summer to early-fall due to the market’s historic tendency to pullback in front of a US Presidential election. We began the process of raising cash in August. The Ned Davis cycle composite for each year includes the 4-year Presidential cycle. The following chart shows the 2020 cycle composite (solid blue line) vs S&P 500’s actual performance to year-to-date (dashed orange line). As can be seen, the S&P 500 tends to top out in early-September and pullback ahead of the election.

Source: Ned Davis Research

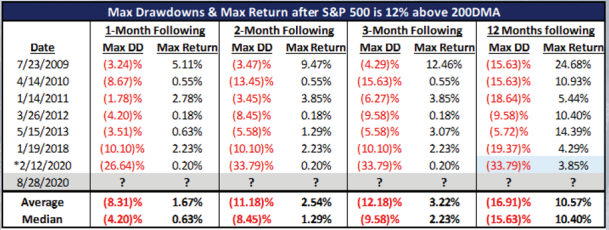

The stock market is also very ahead of itself after 5 months of gains. One simple gauge of this short-term “overbought” condition is the S&P 500’s percentage above its 200-day moving average. Levels greater than 12% are extremely overbought and have shown a strong tendency to pullback. The following chart shows these extreme overbought levels since 2009 vs. the 200-day moving average.

As can be seen, pullbacks tend to occur when the S&P 500 gets this far ahead of itself. The table below shows the remaining upside vs. downside once this condition is met over the next 1, 2, 3 and 12 months. Notice in the short-term, over the next 1 month and 2 months, the risk-return for the S&P 500 is unfavorable with an average decline of 8.3% and 11.2% vs. an average gain of 1.7% and 2.5%, respectively.

Positively, we have seen broad-based indicator improvement since the stock market bottomed in March and Coronavirus cases, deaths and hospitalizations continue to decline. Recent polling shows a narrowing

of the US Presidential and Senate races (suggesting divided government may continue, often a positive for markets) and some segments of the economy, such as housing, remain quite strong. Should a pullback

ahead of the US election occur with limited technical deterioration, the potential for further gains is possible given the $7 trillion stimulus injected into the US economy. Should this transpire, we anticipate

taking advantage of any pullback to reposition VGA strategies at or slightly ahead of benchmark exposures.

One final note

VGA has a value discipline in all our strategies because decades of testing has shown this approach to provide superior risk-adjusted returns. In 2020, growth stocks have gained the most of any equity category but are now valued at over 72 times earnings - more than their peak valuation of 70 times earnings just before the dot-com bubble burst in 2000 and they subsequently lost over 64% through July 2002.

Value stocks and dividend-payers are much more reasonably priced, albeit they remain out of favor. The Russell 3000 Value and Dow-Jones Dividend indices are still down 9.9% and 17.8% year-to-date, respectively. The average US stock, as measured by the Value Line Composite (1700 equal weighted US stocks) is still down 13.3% year-to-date.

The following chart shows that these periods of growth vs value outperformance and underperformance tend to seesaw or “mean revert” after reaching an extreme. The upper clip shows that the spread between growth stocks (red line) and value stocks (blue line) has reached an extreme. The bottom clip shows that the relative outperformance of growth vs. value stocks has now exceeded its peak reached just before the dot com bubble burst. Both clips suggest to us a high level of risk in many growth stocks.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Market Updates

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.