Major equity indices sold off today, with the S&P 500 finishing the day with a 2.5% decline. The sell-off was due to:

However, our indicators suggest a Santa Claus rally is still possible.

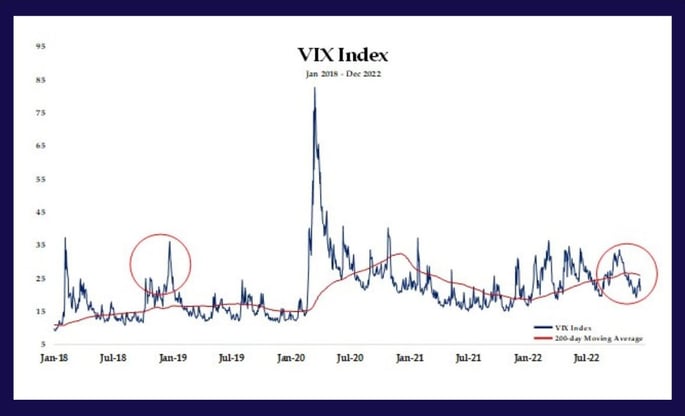

The current sell-off is reminiscent of the one that happened in December 2018, when hawkish comments from the Fed set off a 16% plunge, which left the S&P 500 with a 9% loss for the month. One indicator that is in sharp contrast to the backdrop back then is the VIX index, the so-called “fear gauge’ of the market (higher readings are associated with bigger drops in the stock market). Back in December 2018, the VIX was on its way to spiking to new highs (red circle left) vs. a confirmed downtrend currently (red circle on right).

Source: VGA, data sourced through Bloomberg

Additionally, our objective indicators and macro models are considerably more positive now than they were back then (see below).

Source: VGA, data sourced through Bloomberg

One reason for our better macro model readings now vs Dec 2018 may be that recent inflation reports show that the Fed is winning its battle to bring inflation down. In early-December, the BLS reported that November headline inflation (CPI) was only +0.1% on a sequential month-over-month basis, which suggests year-over-year inflation will come down to the Fed’s 2% mandate by June 2023. If inflation pressures subside, the Fed can back off its monetary tightening policies sooner than it projected yesterday.

Fed funds futures (the market’s expectations for interest rates) show short-term rates are likely to peak at 4.9% in the spring of 2023 (vs the 5.1% the Fed suggested yesterday) and then interest rate cuts from the Fed are likely thru the rest of the year (vs. the Fed’s projections for its 5.1% rate being maintained through year-end).

Technically, the S&P 500 should hold 3800-3825 without VIX exceeding 28-29 or extreme negative internals (aka “sell thrusts”, which are days with greater than 10-1 negative S&P 500 issue breadth and greater than 15-1 negative S&P 500 volume breadth).

Strategy-wise, we are positioned in line with respective benchmarks given the indicator improvement we have seen since mid-October’s stock market low, after being defensively positioned all year. While we are giving this pullback some leash, we are monitoring its technical underpinnings closely.

We were not surprised to see a pullback in the stock market this month due its short-term overbought condition and December’s seasonal tendency for better performance in the back half of the month. Note on the chart below, while December tends to be a good month for the stock market, the majority of its gains come in the back half.

Source: Bespoke

As always, our process will continue to follow the weight of evidence from our objective indicators and models, which currently suggest that worst of the bear market of 2022 is over.

VGA Investment Team

Vineyard Global Advisors offers a range of investment strategies designed to allow participation in the market's growth within a dynamic, risk-managed framework that seeks to protect against significant market declines. Our goal is to give our clients greater peace of mind by generating steadier returns over time. Contact us to learn more.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.