There is no denying the outlook for the stock market is getting a little cloudy. With recent selloffs and the Fed battling inflation by raising rates, paired with differing opinions about a possible looming recession, it’s easy to feel like we might be looking at a more extended stay in bear territory.

The last two years have ushered in growth that more than doubled stock values. That kind of rise makes it easy to see that a drop of 20% or more is possible. Confidence is weakening, consumer sentiment is low, and war-related inflation is causing economists to wonder just how low the markets will go.

It’s like hiking through a glorious national park, surrounded by waterfalls and giant pines. As you approach a beautiful vista, you come across a posted warning that you are nearing bear territory and the little hairs on the back of your neck begin to tingle. That feeling of knowing you are closer to danger makes you wish that you knew what to look out for or what to do if a bear appears on your trail. If you knew, you would be carrying a bear bell or pepper spray or something to protect yourself. The unease makes you wary and you promise yourself that next time you hike, you will be more prepared.

Learn more about preparing for a bear market here.

According to John Hancock, there are three characteristics of a bear market:

The time frame that securities stay low is important to note, usually, a drop in price paired with a two-month or more period of time staying below that 20% mark indicates a big hairy bear. It is also tricky trying to figure out how long a bear market will last. It depends on who you ask, some say it won’t last long but some warn that the next downturn could mimic the bear market we experienced back in 1973-74 when many of the political and economic concerns then, mirror those of today. (WSJ/James Mackintosh/5-22-22)

So preparation is something we like to talk about. It was the star of our previous blog, Is That a Storm on the Horizon?, and it is something that we specialize in at Vineyard Global Advisors. It is what we do.

We strive to help our clients sleep easier during bear markets with our disciplined approach of striving to win by losing less.

No one knows what the future holds, sometimes the best we can do is to prepare for all of the scenarios. If you think that things might look rough you can arm yourself with a great defense, ready for the ups and downs that will come. A balanced portfolio will help but the best defense is moving into active management. There are so many benefits to having a team that is more than prepared. Here are a few:

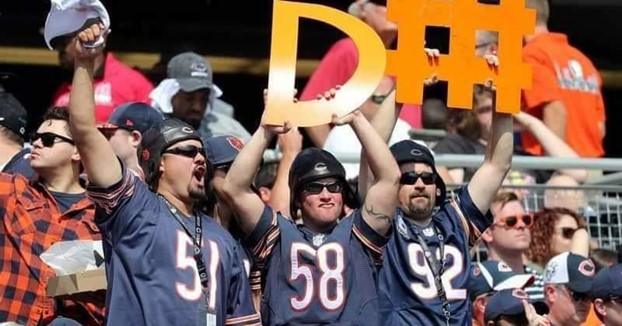

Defense! Defense! Defense!

Defense! Defense! Defense!

If you need more convincing that Active Management is right for you, consider how much easier it is to know you are protected when you have a team behind you planning for anything that might come your way.

Imagine you are back on that hiking trail, at the beautiful vista and you stumble and take a fall into a deep crevasse. Going it alone, without a team, you fall to the deepest part of the pit. Once you reach the bottom, you realize that the only way out is all the way back up to the top. It will be a long, slow, arduous climb. Now imagine that same fall, but this time your team is with you. They already have a plan in place for this situation. You still fall but you land on a ledge that is nowhere near the bottom. As you look back up, you see that there isn’t much of a climb to get back up to safety. It will take much less time to get out compared to the climb you would have faced from the bottom.

Having a plan, and a team in place is the best protection from steep falls.

There hasn’t been a better time than now to find out how much the team at Vineyard Global Advisors can assist you in getting back up onto the bull.

If you are concerned about a looming bear market consider these points:

Have a look at VGA’s strategies here. Our disciplined approach helps clients sleep easier during bear markets, and beyond.

Vineyard Global Advisors offers a range of investment strategies designed to allow participation in the market's growth within a dynamic, risk-managed framework that seeks to offer protection during significant market declines. Our goal is to give our clients greater peace of mind by generating steadier returns over time. Contact us to learn more.

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.