The trend of investing in Mutual Funds and ETFs is waning. More and

more investors are looking for active and individualized money management. If you are looking to personalize your portfolio to better fit

your goals and lifestyle, you are probably looking into a separately managed account.

Separately managed accounts, or SMAs, are investment accounts held by individual investors and invested by a professional money manager. These accounts can be personalized based on your financial and tax needs, as well as your personal preferences. Other names for these types of accounts are wrap accounts, private accounts, or individually managed accounts.

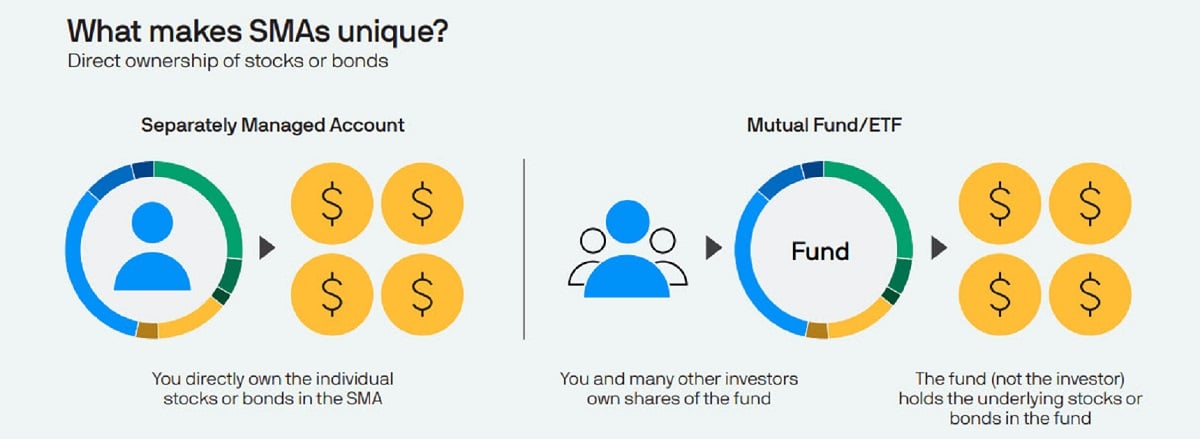

What makes SMAs unique? The key difference is what you own as an

investor. With a mutual fund or ETF, you and many other investors own

shares of the fund, not the individual stocks or bonds inside the fund. With an SMA, you directly own those stocks or bonds in an account separate from others, giving you flexibility in tailoring strategies to your personal goals, preferences, and tax needs.

JP Morgan

JP Morgan

In other words, an SMA is not a one-size-fits-all type of vehicle. Instead, it is a shiny car built just for you, with every option you desire. It is yours to

own, and it even comes with a money manager to drive for you, striving to keep you safe on the bumpiest roads and deliver you to your planned

destination.

Read more - Four Reasons Why SMAs are Great For Investors

SMAs can give you a greater voice in what your portfolio owns and how it

is traded or taxed. But are they right for everyone? It was only 10 years ago that the minimum investment to participate in an SMA was $1 million of investable assets or higher. Larger firms like Charles Schwab and Morgan Stanley are working to democratize these types of accounts for investors.

We are now seeing minimums as low as $10,000 for an SMA that holds

fractional shares of stocks or ETFs. This makes participation so much more accessible. They are no longer just for high-net-worth individuals and are becoming an attractive option for those who are retired or who have more money from a 401k plan to invest.

“According to Cerulli Associates, there is about $2 Trillion in

assets in these accounts, up 14.1% from $1.72 Trillion in assets in

2022, and assets in these accounts are projected to reach 2.9

Trillion by 2026”. WSJ - 1-9-24

So, the barriers to entry are much lower, but many caution that SMAs still

aren’t for everyone. They might be right for you if:

There is also the cost to consider. SMAs are, by definition, actively

managed, which many believe the average investor should avoid in favor of lower-cost passive mutual funds or ETFs. Average fees depend on many factors, including financial advisor and asset management fees. However, they are very competitive with the average fees associated with participation in mutual funds or ETFs.

SMA investors can avoid the sneaky hidden costs of comingled investors in a mutual fund. SMA management fees are competitive with and often less than, the fees charged by advisors using mutual funds or ETFs. Many

advisors charge an advisory fee in addition to mutual fund fees, creating

many layers of fees. SMA manager fees are often less expensive as they have become more available over the years. The minimums for an SMA are now lower than ever, making them more affordable and easier to access.

There are very specific tax advantages to investing with a separately

managed account. If you are invested in a mutual fund, you can’t control

the capital gains distributions - but you can in an SMA.

“Tax loss harvesting is one reason many people are opening SMAs for direct indexing - an investment strategy that involves layering the

underlying securities of an index such as the S&P 500. It lets them sell individual stocks that have declined in value to realize losses so they can offset capital gains and keep more profits.” WSJ - 1-9-24

There are many ways of managing taxes with SMAs:

Investors who seek exposure to several different investment styles should investigate the use of SMAs. Find a wealth manager who has the ability to customize your portfolio and has the experience and flexibility to pivot and adjust as your needs change.

SMAs are customized, personalized, tax-efficient, accessible, and affordable, making them an excellent vehicle for your investments.

Vineyard Global Advisors portfolios are individually constructed to fit your goals:

Vineyard Global Advisors offers 13 fee-only, actively managed,

including hedged and long-only investment strategies via

separately managed accounts.

This includes private credit options for accredited investors.

Contact Us to learn more.

|

|

Investment advisory services are provided through Integrated Advisors Network, LLC (“Integrated”) a registered investment advisor. Registration does not imply a certain level of skill or training. Vineyard Global Advisors, LLC is a practice group of Integrated.

The opinions expressed herein are those of Vineyard Global Advisors and are subject to change without notice. This material is not financial advice or an offer to sell any product. Forward-looking statements cannot be guaranteed. This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Vineyard’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future. Vineyard Global Advisors is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Investment advisory services offered through Integrated Advisors Network, LLC (“Integrated), a registered investment advisor. Vineyard Global Advisors is a DBA of Integrated.

Investors cannot invest directly in an index.

There is no guarantee that the investment objectives will be achieved. Moreover, past performance is not a guarantee or indicator of future results. Does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations.

Integrated is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Business is only transacted in states in which it is property registered or is excluded or exempted from registration. A copy of Integrated's and VGA's current written disclosure brochure filed with the SEC which discusses among other things, business practices, services and fees, is available through the SEC's website at: www.adviserinfo.sec.gov

These Perspectives on Strategy

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2026 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.